Patel Engineering

Patel Engineering’s shares soared by 6% on April 26 after it was awarded an irrigation project by the Maharashtra water resources ministry. The shares were trading at 3.9% higher at Rs 20.67 on the BSE at 10:17 am. In the past month alone, the stock has surged by almost 40%.

Mankind Pharma

Mankind Pharma’s IPO garners strong response with bids for 58 lakh equity shares, representing 21 percent subscription, on the second day of bidding, as of April 26. The offer size is for 2.8 crore shares. The first day of the IPO saw a subscription of 14 percent.

Maruti Suzuki

Maruti Suzuki releases Consolidated Quarterly Results for March 31, 2023. Maruti Suzuki has announced an increase in total income from Rs. 29918.4 Crores as of December 31, 2022, to Rs. 32802.5 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 2391.5 Crores as of December 31, 2022, to Rs. 2670.8 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 79.17 on December 31, 2022, to Rs. 88.41 on March 31, 2023, according to the company’s statement.

HDFC Life Insurance

HDFC Life Insurance releases Consolidated Quarterly Results for March 31, 2023. HDFC Life Insurance has announced an increase in total income from Rs. 19718.24 Crores as of December 31, 2022, to Rs. 21470.50 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 315.91 Crores as of December 31, 2022, to Rs. 361.97 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 1.48 on December 31, 2022, to Rs. 1.70 on March 31, 2023, according to the company’s statement.

Union Bank

Union Bank of India’s Board of Directors met on April 26, 2023, and announced their approval of a capital plan that aims to raise up to ₹10,100 crores. The plan is subject to certain conditions, including obtaining approval from the government of India, other regulatory bodies, and the bank’s shareholders.

KPIT Technologies

KPIT Technologies releases Consolidated Quarterly Results for March 31, 2023. KPIT Technologies has announced an increase in total income from Rs. 938.174 Crores as of December 31, 2022, to Rs. 1023.627 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 100.49 Crores as of December 31, 2022, to Rs. 111.6 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 3.68 on December 31, 2022, to Rs. 4.09 on March 31, 2023, according to the company’s statement.

KEC International

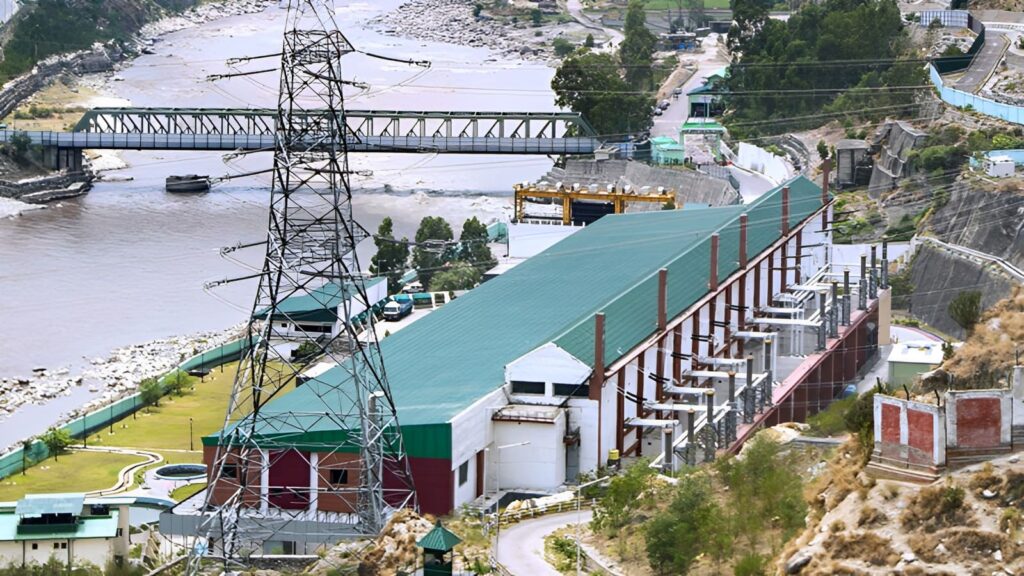

KEC International Ltd., an infrastructure EPC company under the RPG Group, has recently announced new orders amounting to Rs. 1,017 crores for its various business operations. The company has been awarded an order for a 765 kV transmission line from a private developer in India through its Transmission & Distribution (T&D) business.

Poonawalla Fincorp

Poonawalla Fincorp releases Consolidated Quarterly Results for March 31, 2023. Poonawalla Fincorp has announced an increase in total income from Rs. 516.40 Crores as of December 31, 2022, to Rs. 580.71 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 182.11 Crores as of December 31, 2022, to Rs. 198.37 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 2.35 on December 31, 2022, to Rs. 2.57 on March 31, 2023, according to the company’s statement.

IIFL Finance

IIFL Finance releases Consolidated Quarterly Results for March 31, 2023. IIFL Finance has announced an increase in total income from Rs. 2144.48 Crores as of December 31, 2022, to Rs. 2276.01 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 378.30 Crores as of December 31, 2022, to Rs. 412.74 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 9.90 on December 31, 2022, to Rs. 10.79 on March 31, 2023, according to the company’s statement.

Bajaj Finance

Bajaj Finance releases Consolidated Quarterly Results for March 31, 2023. Bajaj Finance has announced an increase in total income from Rs. 10786.03 Crores as of December 31, 2022, to Rs. 11363.14 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 2973 Crores as of December 31, 2022, to Rs. 3157.79 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 48.96 on December 31, 2022, to Rs. 52.01 on March 31, 2023, according to the company’s statement.

L&T Tech Services

L&T Tech Services releases Consolidated Quarterly Results for March 31, 2023. L&T Tech Services has announced an increase in total income from Rs. 2122.8 Crores as of December 31, 2022, to Rs. 2146 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 303.6 Crores as of December 31, 2022, to Rs. 309.6 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 28.66 on December 3 1, 2022, to Rs. 29.22 on March 31, 2023, according to the company’s statement.

Voltas

Voltas releases Consolidated Quarterly Results for March 31, 2023. Voltas has announced an increase in total income from Rs. 2036.27 Crores as of December 31, 2022, to Rs. 3003.46 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. -110.38 Crores as of December 31, 2022, to Rs. 143.92 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. -3.34 on December 31, 2022, to Rs. 4.35 on March 31, 2023, according to the company’s statement.

Syngene International

Syngene International releases Consolidated Quarterly Results for March 31, 2023. Syngene International has announced an increase in total income from Rs. 803.1 Crores as of December 31, 2022, to Rs. 1017.2 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 109.7 Crores as of December 31, 2022, to Rs. 178.7 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 2.71 on December 31, 2022, to Rs. 4.43 on March 31, 2023, according to the company’s statement.

SBI Life

SBI Life releases Consolidated Quarterly Results for March 31, 2023. SBI Life has announced an increase in total income from Rs. 26626.71 Crores as of December 31, 2022, to Rs. 22805.40 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 304.13 Crores as of December 31, 2022, to Rs. 776.85 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 3.04 on December 31, 2022, to Rs. 7.76 on March 31, 2023, according to the company’s statement.

Indus Towers

Indus Towers releases Consolidated Quarterly Results for March 31, 2023. Indus Towers has announced an increase in total income from Rs. 6854.8 Crores as of December 31, 2022, to Rs. 6869 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. -708.2 Crores as of December 31, 2022, to Rs. 1399.1 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. -2.63 on December 31, 2022, to Rs. 5.19 on March 31, 2023, according to the company’s statement.

Oracle Financial Services

Oracle Financial Services releases Consolidated Quarterly Results for March 31, 2023. Oracle Financial Services has announced an increase in total income from Rs. 1490.096 Crores as of December 31, 2022, to Rs. 1531.791 Crores as of March 31, 2023. The net profit for the company has decreased from Rs. 437.330 Crores as of December 31, 2022, to Rs. 479.302 Crores as of March 31, 2023. However, the earnings per share (EPS) have improved, increasing from Rs. 50.44 on December 31, 2022, to Rs. 55.24 on March 31, 2023, according to the company’s statement.

For More Latest News Click Here